Our Methodology

OUR CORE

PRINCIPLES

Four fundamental principles guide our investment management process. We strictly prioritize management of absolute risk while adhering to an agreed upon performance-related benchmark defined by the client. We believe in the unsurpassed value of fundamental analysis capable of identifying the most undervalued assets around the globe. We consistently filter out any market noise and trending investment themes to avoid overcrowded and risky trades, while at the same time ensuring we invest only in liquid enough securities or investment vehicles that provide full transparency.

We firmly believe that markets are inherently inefficient. This creates opportunities to generate significant value for investors by taking advantage of market excesses, through an active and disciplined investment management approach.

Benchmark Aware

not Benchmark Driven

Fundamental Reasoning

not driven by Behavioral Bias

Disciplined Selection

not influenced by Market Noise

Active Approach

not simply Streamlining Operations

Investment Guidelines

OPTIMISE RISK-RETURN REWARD

Aiming to deliver superior risk-adjusted returns over time. Variability of portfolio returns (risk or volatility) is a necessary but often overlooked performance component. We manage the volatility of the portfolio in order to distill safety and robustness of the managed assets

BEING DISCIPLINED

The greatest investment risk is paying too much for an asset. We are benchmark aware but not benchmark driven, and we assign greater impor tance to the management of absolute and not relative risk.

Rule #1: Avoid losing money.

Rule #2: Don’t forget Rule 1

AVOID MARKET NOISE

Capture any uncovered investment oppor tunity by favoring out of consensus and contrarian positioning, while at the same time avoiding

distracting market noise. Remain adaptive to surrounding dynamics. Timing matters only in short term

EXCLUDE RANDOM BETS

Every single investment decision should be based on a solid economic rationale in order to minimise the role of luck. Use skill to maximise the “rationality and economic judgement” factor

OPT FOR TRANSPARENCY

A ssessing a global investment universe, with no a-priori restrictions on geographical markets, currencies or types of investments and asset classes, as long as certain strict financial repor ting and investor disclosure requirements are met

EXPLOIT MARKET INEFFICIENCIES

We believe that markets are inherently inefficient and create opportunities until normalised equilibriums are found. Constantly looking for deeply

undervalued assets and securities across all markets, sectors and geographies

Investing is a lively and dynamic procedure. Although we are cognizant of some of the merits that passive strategies can offer, we are firm believers that investing should be a close reflection of a constantly changing world and economic environment. Trough and peaks, along with a series of other unpredictable events are to experience in almost any type of cycle, economic or not. Through our active approach, we aim to alleviate the exposure to such adverse events and assure a smoother value development and superior risk-adjusted performance over time.

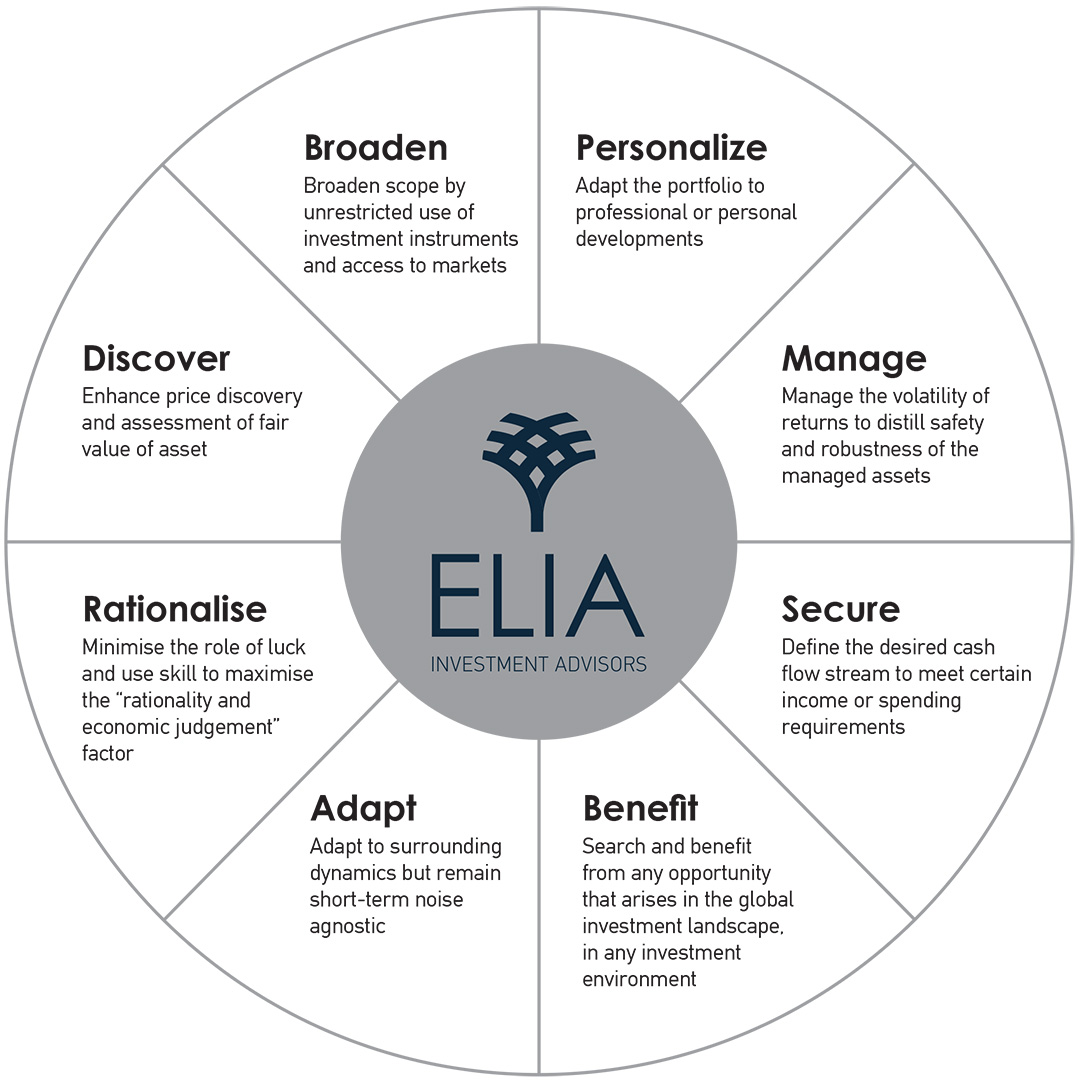

OUR INVESTMENT APPROACH

We are firm believers in the merits of macro and microeconomic analysis, and this also defines the approach we apply to our investment management activities. We have developed three powerful proprietary tools for the successful execution of our investment strategies:

Proprietary Toolkit

QUANTAMENTAL METHODOLOGY

combines advanced quantitative and fundamental economic analysis

MODULAR APPROACH

a series of model portfolios (ELIA modules) reflecting our evolving market views on every major asset class and currency

V.A.L.U.E. FRAMEWORK

holistic and refined fundamental methodology for locating attractive, and undervalued companies across various market geographies and sectors

QUANTAMENTAL

ELIA QUANTAMENTAL is a proprietary methodology we have developed over the years, guiding our investment decisions in every phase of our analysis.

As the name implies, this methodology combines advanced quantitative and fundamental economic analysis. Our QUANTAMENTAL framework combines dynamic technical indicators, asset valuation techniques, leading macro mapping, advanced statistics, implied volatility, market sentiment, use of alternative data, and momentum metrics.

At portfolio construction level this investment framework ensures that the optimal composition is achieved both at asset class, as well as at single security level.

Our Quantamental framework empowers us to properly assess market dynamics and develop timely action plans

Implied Volatility Analysis

Advanced Statistical Metrics

Sentiment & Momentum

Alternative Data

Dynamic Technical Analysis

Correlation & Optimisation Testing

Leading Macroeconomic Indicators

Asset valuation

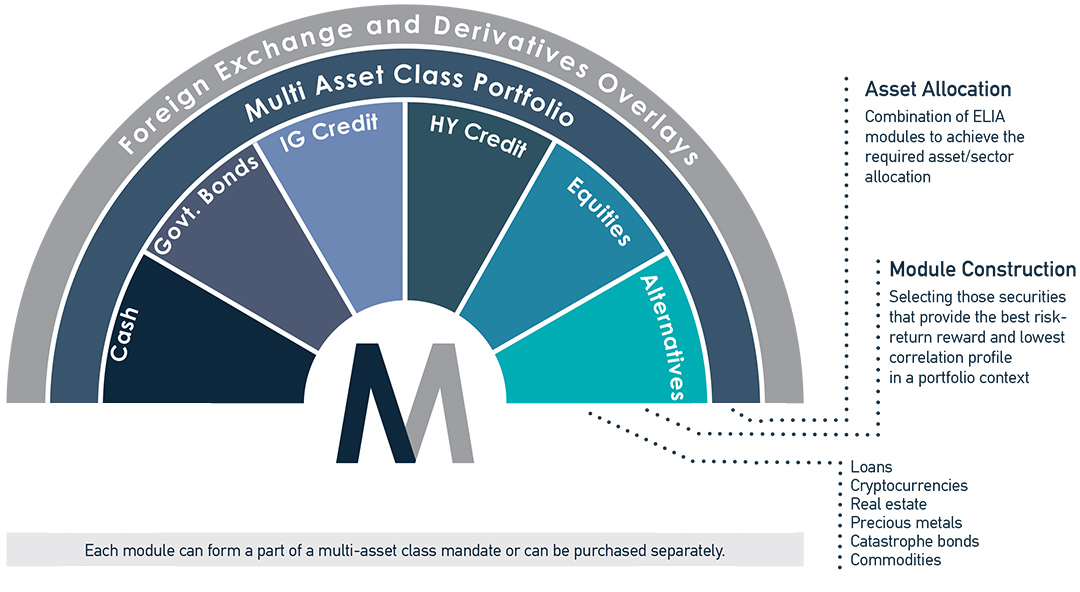

MODULAR

We have designed a series of model portfolios (ELIA modules) reflecting our evolving market views on every major asset class and currency. Each module comprises a select list of what we deem as the most undervalued securities in their respective category. This selection is the result of a thorough analytical process based on our Quantamental framework and aims to optimise the composition and risk-return profile of each particular module in a dynamic fashion.

We can meet the narrowest or most specialised client mandates

V.A.L.U.E. FRAMEWORK

At the heart of the ELIA modular approach lies our framework of analysis called “V.A.L.U.E.”. This is a holistic and refined fundamental methodology of locating attractive, and undervalued companies across various market geographies and sectors.

The “hidden” fundamental value of these companies is being assessed against their historical and implied volatility profiles. The combination of these factors provides fairly good signals with regard to their upside potential as well as the best way to initiate a new position in these securities.

Volatility Adjusted Long-term Undervalued Equities

The V.A.L.U.E framework has its foundation on six fundamental attributes that, in our view, define a successful business or a valuable company from an investor’s perspective. The level of V.A.L.U.E is determined across six dimensions combining strategic, financial, non-tangible, and ESG-related metrics.